IOS organises lecture on “A Better Approach to Profit, Dividend and Financial Compensation: Empowering Shareholders”

In collaboration with Quwathul Islam Group of Institutions at MQI Degree College (Quwathul Islam), Bangalore (Karnataka) on October 24, 2018

The Institute of Objective Studies, organised a special lecture on “A Better Approach to Profit, Dividend and Financial Compensation: Empowering Shareholders” at MQI Degree College (Quwathul Islam), Bangalore (Karnataka) on October 24, 2018 in collaboration with Quwathul Islam Group of Institutions. Delivering the lecture, Dr. Kaleem Alam, Researcher at Islamic Economics Institute, King Abdul Aziz University, Jeddah, Saudi Arabia, pitched for empowering shareholders in all major decision-making processes of the corporation failing this could be imputed as giving a free hand to the management and controlling stake holders to take decisions without fear of any checks and balances. He believes, specially in case of borrowing on behalf of the company, the approval of shareholders must be sought.

Dr Alam divided his lecture into two parts, the first focused on profit and the second focused on debt and debt clarity.

He believes that Companies Act needed to be amended requiring that a company announces 35% of the net profit as dividend to shareholders. This amendment would enable the shareholder to take interest in the activities and performance of the company. Currently the focus of majority of shareholders is only on price movements and not the company’s performance.

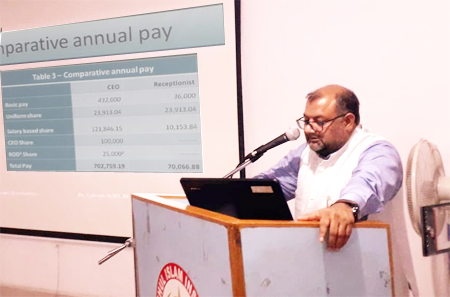

He also advocated that employees of a company must have the right in the profit of the company. He believed that this percentage had to be in the contract of employees. They must know how much percentage of the profit will be reserved for employees and how it would be distributed among them. This would enable employees to improve the financial performance of the company. He wanted to see a cap on the payment of the top executive (fixed remuneration) and instead to be awarded based on the performance of the firm.

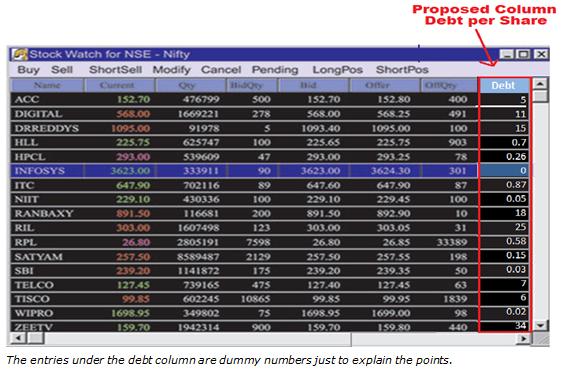

Dr. Alam wanted to see capital market authorities to include and require all online broker platforms to display debt per share of the company on the screen. This in effect would warn the share buyers about how much debt (risk) they purchased with each share. In case of India, the Stock Exchange Board of India (SEBI) could consider the recommendation.

Once the debt per share information is enabled to be displayed on screens along with percentage distribution of dividend is made compulsory as and when the profits are made, then he proposed that the shareholder must be made to repay the financial debt (borrowing) of the company based on the number of shares held by shareholders.

He believed this would also resolve the rising NPAs (Non Performing Assets) problems of banks.

He explained the requirement of the two (the compulsory distribution of dividend and introduction of debt per share) was important to stop reckless borrowing, sometimes just to expand for the sake of expanding at very high interest rates. This endangers the profitability of the company and rights of owners on the profit, as profits would be eaten away in serving the interest repayments.

He believed doing so would empower even a non-profit organization and laymen to park their funds in the share market without much fear of loss by choosing to invest in companies with less debt. They could hope for some returns on profit as and when profits were made. Having a cap on top executive payments would further ensure greater profitability.

Ensuring shareholders were held responsible for debt (borrowings) of the company would enable the cost of borrowing to be brought down drastically, he observed.

He wanted shareholders to attend annual general meetings and emergency meetings of the company, if possible. He also wanted shareholders to actively participate in decision-making by way of responding to different polls and opinions sought by the company at different times.

Earlier, the lecture began with the recitation of a verse from the Quran by Maulana Qari Mohammad Muzaffar Umri, president, All India Milli Council, district Bangalore, Karnataka. Syed Saghiruddin Afsar Quadri, secretary, Milli Council, Karnataka, read out the translation of the verse. Prof. Y. Aezaz Ahmad, Director of Quwathul Islam Degree College, welcomed the guests. Jameel Ahmad, member of the general assembly of the IOS, introduced Dr. Alam to the audience.

The proceedings of the lecture were conducted by Mohammad Abul Hasan Ali, a first-year student of St. Joseph’s College. He also extended a vote of thanks.

Those who attended the lecture included Syed Shahid Ahmed, general secretary, All India Milli Council, Karnataka, Mohammad Farooq, assistant general secretary, All India Milli Council, Karnataka and Syed Mazhar Qadri, general secretary, Milli Council, Bangalore. Teachers and students of Quwathul Islam Degree College, B.E.T. Degree College, H.A.B.K. College and other institutions managed by Muslims also attended the lecture, besides professionals connected with economic affairs. The function ended with a dua by Maulana Shah Qadri Syed Mustafa Rifai Jeelani, assistant general secretary of All India Milli Council and member, general assembly of the IOS.

Go Back