Ground Prepared For Participatory Banking

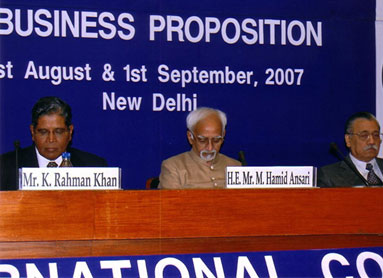

A two-day conference kickstarts the introduction of non-exploitative and equitable procedures of banking and finance in India

Vice President of India Hamid Ansari said that “participatory banking” practices had been prevalent in the country since ancient times. Quoting the 11th century globe-trotter al-Biruni he said in India there was a revulsion against usury at that time.

Vice President of India Hamid Ansari said that “participatory banking” practices had been prevalent in the country since ancient times. Quoting the 11th century globe-trotter al-Biruni he said in India there was a revulsion against usury at that time.

Speaking at a two-day international conference on “Participatory Banking For All: A Business Proposition” he said that economic development was stratified across the world. Participatory banking, also known as Islamic banking, would address the banking and financial needs of all economic strata, he added.

The conference was organised jointly by Institute of Objective Studies (IOS) and Indo-Arab Economic Cooperation Forum (IAECF) at Parliament House Annexe on August 31 and September 1.

Former Deputy Prime Minister of Malaysia Anwar Ibrahim said that it was time for “an open economy and open society” like India to allow Islamic banking which would be of advantage to all Indians.

He elaborated that participatory banking was based on the prevention of usury and observation of Sharia scruples. However, he advised that Islamic banking should also incorporate the moral imperatives of environmental protection, gender justice and micro-credit which many non-Islamic financial institutions had incorporated in a remarkable way.

He elaborated that participatory banking was based on the prevention of usury and observation of Sharia scruples. However, he advised that Islamic banking should also incorporate the moral imperatives of environmental protection, gender justice and micro-credit which many non-Islamic financial institutions had incorporated in a remarkable way.

Chairman Indian Banks Association MBN Rao explained the basics of Islamic banking and hoped that it would prosper worldwide, including India.

IOS Chairman and President Indo-Arab Economic Cooperation Forum in his welcome address said there was no doubt that participatory banking had proven to be a successful financial experiment of post-World War II. It had found acceptance wherever it operated in different parts of world, from east to west.

He explained that western financial institutions were offering products that comply with tenets of participatory banking. Banks like Citigroup, Deutsche Bank, HSBC, Lloyds TSB, Standard Chartered Bank and UBS were actively involved.

Similarly, news from Russian banks and from Switzerland as well as China indicated a keen interest in developing participatory banking methods to serve a wider global market.

Similarly, news from Russian banks and from Switzerland as well as China indicated a keen interest in developing participatory banking methods to serve a wider global market.

“The Institute of Objective Studies has been promoting and researching the subject of participatory or interest-free banking over the last 15 years. We have published seminal works on this subject of far-reaching importance”, he added.

Former Chief Justice of India Justice AM Ahmadi said that considerations like human welfare, environmental protection and “human-friendly principles” should be part of Islamic banking, which already was based on certain ethical principles.

He pointed out that Articles 38 and 39 of the Constitution envisaged a welfare state, which was a midway house between a capitalist and a socialist system. This format, he argued, shared many features with participatory banking that was a non-exploitative way of transacting business.

Vice-chairman Rajya Sabha K Rahman Khan said that participatory banking was based on Islamic economic principles that entail justice, equity, fair play and non-exploitative relationship. He said the Quran prohibits interest and interest-based transactions. In addition to the prohibition in the Quran, Islamic jurists and economists also based the prohibition on historical, social and economic factors.

Vice-chairman Rajya Sabha K Rahman Khan said that participatory banking was based on Islamic economic principles that entail justice, equity, fair play and non-exploitative relationship. He said the Quran prohibits interest and interest-based transactions. In addition to the prohibition in the Quran, Islamic jurists and economists also based the prohibition on historical, social and economic factors.

“All religions believe charging interest promotes inequity, injustice, oppression and exploitation. Interest is a reward to lender without participating in the risk of enterprise, to which it is lent. In Islamic economy, equity considerations are seen to be the motivation behind economic development”.

He explained the products and the firms involved must meet the basic RBI and SEBI directives, requirements that are set in place to protect the consumer and investor. Those involved – whether as shareholder or customer – must understand what exactly is being offered. There will be long-term damage to the cause if unrealistic expectations are created of what can be achieved. Those providing the services must be wholly professional and competent in what they do. There can be no benefit to any one from the slightest suggestions that the probity and competence with which Sharia-compliant products are provided are in any way less stringent than those of conventional financial products.

Chairman Bayat al-Mal Investment Organisation of Kuwait Sulaiman A al-Qimlas of said that if India opened up to Islamic finance “I will put my money where my mouth is.” He wondered as to why was India reluctant to introduce participatory banking, which was conceptualised by some Indian economists along with others.

Chairman Bayat al-Mal Investment Organisation of Kuwait Sulaiman A al-Qimlas of said that if India opened up to Islamic finance “I will put my money where my mouth is.” He wondered as to why was India reluctant to introduce participatory banking, which was conceptualised by some Indian economists along with others.

IOS General Secretary and member managing committee of the conference Prof. ZM Khan proposed a vote of thanks.

On the second day of the conference, Rajya Sabha (Upper House of Parliament) Deputy Chairman K Rahman Khan said the Government of India was prepared to consider the introduction of participatory banking, also known as Islamic banking, with “an open heart and mind”.

Addressing a press conference at the end of the conference Mr Khan said Union Finance Minister P Chidambram had assured a delegation of the participants that the government was open to the idea of Islamic banking.

Mr Khan said that necessary institutional and regulatory framework had to be put in place to attract foreign direct investment (FDI) from the Islamic financial market. For this the government, Reserve Bank of India, Stock Exchange Board of India (SEBI) and the banking industry would have to take the initiative.

The market worth of such assets today is $700-800 billion and would soon grow to $3 trillion, he added. The conference was of the view that introduction of Islamic bonds (sukuk) and other financial products in India would lead to massive flow of funds.

The market worth of such assets today is $700-800 billion and would soon grow to $3 trillion, he added. The conference was of the view that introduction of Islamic bonds (sukuk) and other financial products in India would lead to massive flow of funds.

Participatory banking, by reorganising Muslim moral and religious scruples against paying and taking interest as well as by respecting taboos on investment in breweries, casinos and pornography, would facilitate large-scale investments from Muslim countries. These values would also not come into conflict with the interests of other people.

Some of the important names in the field participated in the conference, including: Vice President of India Mohammad Hamid Ansari, former Chief Justice of India Justice AM Ahmadi, former Deputy Prime Minister of Malaysia Anwar Ibrahim, Chairman Kuwait’s Bayt Al-Mal Sulaiman N Al-Qimlas, former professor of Economics at Saudi Arabia’s King Abdul Aziz University Prof. MN Siddiqui and Minister-in-charge of West Bengal’s Land and Land Reforms Department Abdur Razzak Molla.

Also present were: CEO of US-based Concord Capital Partners Rudy Yaksick, Director General Fortune Institute of International Business Dr Ahindra Chakarbarty, professor of economics at Egypt’s Zagazig University Dr M Sultan Abou Ali, Executive Vice President of Turkey’s Bank Asia Yousuf Izzetin Imre, Advisor Beary’s Group (Bangalore) MH Khatkhatay, economist at Jeddah-based Islamic Development Bank Dr Mohammad Obaidullah, former professor of economics at Egypt’s University of Alexandria Dr AR Yousri, Managing partner of Kuwait’s Mashoura International Consulting Seraj Al-Baker, chief financial officer UTI AMC Imtiyazur Rahman, secretary Institute of Chartered Accountants of India Ashok Haldia, and chief economist at New Delhi-based National Council for Applied Economic Research Dr Abu Saleh Shariff.

The following three-point resolution was passed at the end of the conference:

-

Participatory banking has emerged as an alternative banking in a number of countries. It is based on equity, justice, fairness in financial transactions, both in mobilising resources and investment of the resources. Interest-based financial transactions are not equitable, just and fair to both borrower and lender. Interest-based finance results in debt proliferation, increased speculation and instability. During last three decades conventional financial markets have introduced new products like mutual funds, venture capital, leasing, equity fund etc. which are not interest based but are in effect participatory financial instruments. The success of mutual funds, venture finance and leasing is a testament to prove that participatory banking is viable in India. With slight marginal changes these can be acceptable to a section of Indians who would not deal in interest. This conference urges the Government of India, the regulators RBI and SEBI and the Indian banking industry to introduce participatory banking in India, by taking necessary legislative and regulatory measure for its establishment.

-

India has more than 150 million Muslims which is the second largest Muslim population of the world. Islamic faith directs that a Muslim should not take interest and/or pay interest. Participatory banking will fulfill the Islamic obligations and meet the aspirations of a large section of India’s citizens. Hence this conference urges the Government of India, RBI, SEBI and the Indian Banking industry, to provide a viable alternative for the 150 million citizens to invest their savings in tune with their religious faith by establishing regulatory mechanism for the establishment of participatory banks and financial institutions in India.

-

The Islamic Financial Market, based on participatory principles is now of the order of more than 700 to 800 billion US dollar, growing at an annual rate of 10% to 15% and poised for a robust growth in the coming years. In the next decade, it is estimated to be in the order of US Dollar 2 to 3 trillions. India needs huge and faster investment for infrastructure and power sectors to maintain the current pace of growth. India can benefit by attracting large funds from the Islamic financial market. Islamic financial market is keen to invest in India. Approval given to Islamic financial products like Sukuk (Islamic bonds) will facilitate entry into India of billion of funds seeking Islamic ventures for profitable investment. An institutional and regulatory mechanism is urgently required for establishment of such institutions which could attract funds from global Islamic financial markets. This conference urges Government of India, RBI and SEBI and Indian Banking Industry to facilitate establishment of Participatory Banking and Financial Institutions by bringing forth necessary institutional and regulatory framework to attract and transfer Foreign Direct Investment from the Islamic financial market.

Go Back